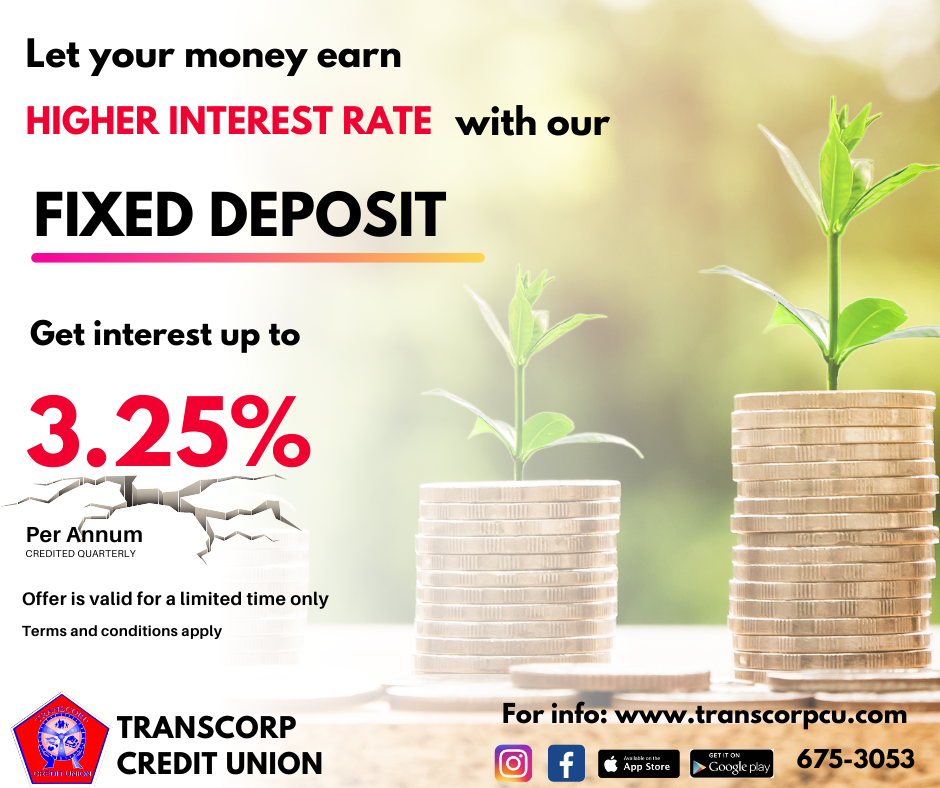

FIXED DEPOSIT RULES AND PROCEDURE

- Transcorp Credit Union (TCU) details the end to end process applicable for managing its revised Fixed Deposit Investment Instrument.

- This Rules and Procedure manual details some of the salient features of the Fixed Deposit (FD) and the locations wherein TCU will accept fixed deposits.

- Fixed Deposit shall mean deposit held by TCU for a fixed period of time agreed upon between the TCU and its member. In exchange for not withdrawing the money during the agreed period, TCU shall pay to the member a larger amount of interest than would be earned from a regular deposit at TCU.

TCU FIXED DEPOSITS: SCHEME FEATURES

A. Scheme Options

I. Non-cumulative Scheme

- In a ‘Non-cumulative’ Fixed Deposit Scheme, the member shall have the option to access the interests payable quarterly. This is applicable to TCU’s deposits for tenors of one year and over. This scheme will be convenient for a member who requires a periodical interest pay-out.

II. Cumulative Scheme

- In a ‘Cumulative’ Fixed Deposit Scheme, the interest is payable at the time of maturity along with the principal and is compounded annually subject to provisions for Premature Withdrawal detailed in this SOP. This scheme is suitable for a member who does not require periodical interest payments and his/her money multiplies with the passage of time.

- Any member participating in this Fixed Deposit Scheme may select anyone of these Scheme options as listed in Section B – Deposit Period below.

- Any Member electing to invest into the six (6) months deposit scheme, upon maturity, shall be paid interest calculated on an annual basis along with a principal deposit.

B. Participation in the Investment Scheme

- The TCU Fixed Deposit Scheme is open for participation by all members.

C. Deposit Period

- There are Four (4) deposit periods as follows:

- Six (6) months

- One (1) year

- Two (2) years

- Three (3) years

- A member has the option to select any period from the above deposit periods. For example, a member may choose a 3-year deposit with a quarterly interest pay-out.

D. Minimum Deposit Value

- A member can participate in this program with a minimum deposit of

$5,000.00TT.

E. Procedure for Deposit/Investment

- Member must apply for Fixed Deposit investment by completing TCU Fixed Deposit Mandate (See attached).

- For new funds, members must provide source documentation in accordance with TCU’s internal policies regarding the same.

- A Fixed deposit Certificate will be issued in the name of the Member.

F. Interest Payment

- The interest rates payables under any of the Fixed Deposit Schemes shall be set by the Board of Directors of TCU from time to time.

- Fixed Deposit Interest payment under the non-cumulative options, will be payable, via cheque or deposit to other savings deposit accounts with TCU or via Automated Clearing House (ACH) to another financial institution.

- Fixed Deposit Interest payment under the cumulative options will be paid at the time of maturity.

G. Pre-Mature Withdrawal

- Premature withdrawal is not permitted before completion of three months from the date of the Fixed Deposit Certificate, except in case of death of the members and upon presentation of Letters of Administration/Grant of Probate in the estate of a deceased member.

- No interest is payable in case of a request for premature withdrawal before the

expiration of six months from the date of the Fixed Deposit Certificate.

- If any sum of money is invested for a period and the Fixed Deposit is broken before the date of maturity, the member will receive a rate of interest applicable to the actual period of investment.

- The member wishing to prematurely withdraw the Fixed Deposit funds shall provide TCU with a minimum of at least two (2) weeks notice of before the intended withdrawal date in writing addressed to the Board of Directors. Member must present an original Fixed Deposit Certificate.

H. Renewal and Payment (Maturity of Proceeds) of Deposit

- The member shall be given written notice along with a New Mandate one month prior to the maturity date of the Fixed Deposit. The option of either renewal, redeposit or repayment will be given to the member.

- The options available are as follows:

- Withdraw my Interest (Only) and pay via Cheque or ACH

- Transfer Interest to my Deposit account and Renew Principal at the current rate

- Renew Fixed Deposit (Principal & Interest) at the current interest rate.

- Withdraw Principal investment via Cheque or ACH

- Where a member fails to request renewal of the Fixed Deposit before seven (7) days prior to the maturity date of the Fixed Deposit, TCU will initiate the maturity process in accordance with the last Fixed Deposit Mandate signed by the member.

- When the maturity date falls on a weekend or public holiday, the repayment will be made on a working day after the maturity date.

I. Mode of Acceptance

- Fixed Deposits investment can be made to TCU via the following modes:

- Cash, cheque, or ACH

- Investment funds must be deposited in accordance with TCU’s AML/CFT Compliance Programme.

J. Terms & Conditions

- Terms & conditions for acceptance of fixed deposits have been detailed in the Fixed Deposit Mandate and can be amended from time to time.

MISCELLANEOUS PROVISIONS

- This Rules and Procedure manual is not intended to breach any of TCU’s Bye-Laws and has been formulated in accordance with the provisions of the Co-operative Societies Act Chapter 81.03.

- Investment funds must be deposited in accordance with TCU’s AML/CFT Compliance Programme.

- Members are permitted to transfer funds from any previous Fixed Deposit Schemes held with TCU. In such instances, interests will be paid at the rate applicable to the previous scheme before transfer into any scheme under this Policy. The terms and conditions under this provision shall apply from the date of transfer of the funds.

- The terms and conditions of this Policy shall be amended by the Board of Directors of TCU from time to time.

Click here for the Fixed Deposit Mandate Form

Access Your Online Account